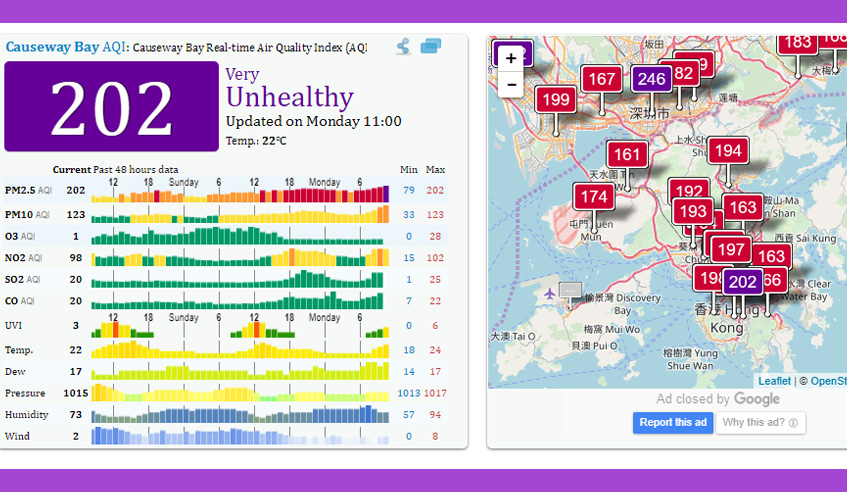

202 and very unhealthy is almost exactly where we are staying on the Island.

Wow, wow. Pollution from China has blown in to Hong Kong…it is shockingly unreal. I had heard the stories but nothing prepares you to see it. The city is basically covered in what you think is fog, but it is not. How can people live in this?….. I like HK but could never live here having seen this, the green fields of England are very appealing at the minute.

The other takeaway of the day was how structured, organised and planned the companies myself and Andy have created are. I am astonished as I always thought we were not. We have always created vague targets, broken down the targets into basic projects, then the projects into lists of things to do, with deliverable dates. All of our organisation has been quite vague and loose, but without going into details I now realise how much we thought about and executed things based on these models. For years we have constantly talked about what we can do, what we should do and how do we get these things done…then tracked the progress to see if we were going in the correct direction. We never stuck our head in the sand and ignored the issues as it appears many people and companies do….. I was gobsmacked.

BITCOIN

So we also went with Tak and Sherman to Cyberport and chatted more and more about Blockchain and ICO’s. I am learning lots and lots about the details. The more I learn the more I believe the valuations of crypto currencies do not make any sense. I am becoming a believer more and more in Bitcoin as a “store of value”, effectively a new form of asset class, like gold…. for these reasons:

- many people believe it has value, hence it does

- when compared directly to gold it is easier to transport

- gold has a market cap of $7 trillion, bonds etc etc are 10’s to 100’s of trillions of dollars, bitcoin is $200 billion!

- as an asset allocation it is very small compared to so many other assets classes

- it was first

- it has huge market share and network effect

- it has huge mind share in the general public

But the other coins do not make sense in respect to their market valuations. They are almost all involved in some form of transaction/date play and hence:

- many coins are playing in similar markets ( bitcoin may also be playing in this space with the introduction of Lightning )

- the established players Paypal, Visa, Mastercard, banks etc etc will all adapt to the new world

- the market will be massively fragmented, with no overall winner

- maybe there will be some winners, but which ones?

So safety bets for me say invest and hold bitcoin. Speculative bets trade in and out of the rest depending on which coin looks interesting on the day/month. Get in as early as possible with the interesting ICO’s.

The Evening

The Peak at night, with some pollution…… plus Rainbow Cheese Toasty for Andy…plus beer:)