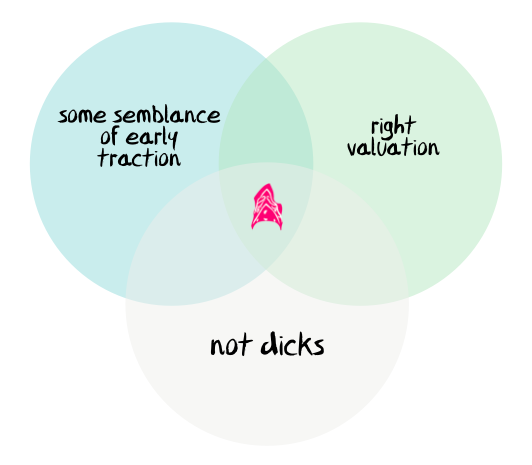

In the grand scheme of things, we’d like to think that we’re not The Evil Investor. And while we don’t exactly have a 231491221-page long investment thesis (who reads those anyway?), this Venn diagram should explain our crazy methods nicely.

If you’re an early-stage startup, well, this is what we’re looking for.

Introducing our Circles of Madness, or, how we choose which startups we want to invest our time, money, mentorship, Thai food in. Read on for an explanation for each circle, anti-clockwise!

Some Semblance of Early Traction

Ideas are great and all, but we like to invest in teams that are execution machines. Early traction can mean absolutely nuts, or it can be a pretty important indicator of how you’re planning to continue along your startup journey. Even numbers that you may think are insignificant (low two-digits for an ecommerce business, one paying trial customer for a B2B, etc.) are indicative of the fact that there might be something there worth exploring. That’s always interesting, and that’s always something we want to talk about with you.

And if you’re an early-stage startup, we want you to explore! But do it as quickly, and as leanly as you can. We want to hear the rationale behind your experiments — it gives us important insight to how you think and what you might do next. We’ve been in the business long enough that we know what doesn’t work, and can then mentor you accordingly.

Not Dicks

This also applies to you if you weren’t biologically born with one. Quite un-PC, but basically, we look at your character, team dynamics, how you take our feedback and whether we can get along. If we don’t like you, chances are we won’t invest in you either.

It’s important, because if we invest in you, we’re in it with you, and whether you take our feedback onboard or not (and you don’t have to when you think you shouldn’t!), you want to be the kind of team we enjoy getting a coffee/pint/meal with.

And really, it’s not difficult to not be a dick. General niceties, common courtesies you’d extend to another human being, thank you emails after a mentoring session, stuff like that.

Also, Paul Smith from Ignite stresses this same point to every new cohort that walks through their doors, so we’re probably on the right track!

Right Valuation

So, what does early-stage mean? In this overheated environment, our sweet spot is currently £800,000 to £1.5 mil pre-money. You’re a team that might have figured out that there’s something to pursue in your original idea, or don’t have a full-fledged product yet, or haven’t figured out true product-market fit. We understand that what you might have now is probably not what you’ll be selling in the next two months even. We’re not expecting you to have figured everything out yet.

This is definitely a very simplistic explanation of a tricky subject that’s usually more art than science at this stage, and we think we could probably write another detailed article on startup valuations alone, so watch this space!

Do you have what we’re looking for?

Having said all that, we’re always on the lookout for new startups!

Here’s where you can apply to be considered. We don’t bite, much. :)

Doug

Connect and follow me: